The expanding global pharmaceutical market is projected to have a value of $1.226 trillion by 2018.1 The figure is impressive yet it places significant pressure on pharmas to bring to market innovative drugs. Faced with that pressure, many pharmas are streamlining their supply chain to focus on their core competencies and bring products to market faster. As a result, many pharmas are outsourcing non-central components, and more than half of them have budgeted to increase outsourcing in 2012.2

The pharmaceutical packaging industry, as a provider of contract services, is not surprisingly experiencing a corresponding market growth. As with the pharma industry, packagers are challenged to grow through innovation, by providing formats which satisfy pharma’s expectation of enhanced drug integrity, safety and stability while delivering the convenience demanded by today’s consumer.

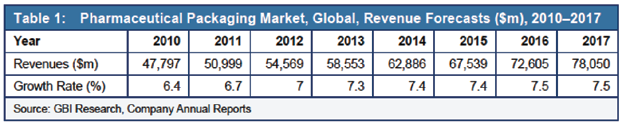

Valued at $47 billion in 2010, the global pharmaceutical packaging market is forecast to increase even more rapidly than the pharmaceutical market, at a compound annual growth rate (CAGR) of 7.3%, reaching $78 billion by 2017. 1 Such growth is a clear indicator of the significant role pharmaceutical packaging will play in the pharmaceutical industry’s quest for growth through innovation. Beyond that, pharmas look to packagers to improve bottom lines and brand distinction.

Globally, there are more than 2,000 pharmaceutical packagers competing for a larger share of the market. The challenge for pharmas is to winnow the overwhelming number of options and identify one which will advance their products, assume the regulatory burden and ensure a competitive edge.

Factors typically involved in making outsourcing decisions, according to Contract Pharma’s 2011 Outsourcing Survey, would have confidentiality, quality and cost at the top of the list. Three fundamental prerequisites, to be sure. Yet, a valid evaluation should include a few often-overlooked characteristics – factors which will shape an effective partnership, not just in the short term but into the future.

As the growth opportunities for contract packagers escalate, are they, and will they be, able to accommodate the increased demand? Capacity becomes a strategic issue. Do packagers have ample available capacity for your present needs as well as to expand as demand and innovation warrant? Can they provide high-capacity output that does not compromise quality and excellence? Do they offer a full range of services not only for convenience but, importantly, for the elevated level of quality control that comes from using a single outsourcing partner? Are they equipped and staffed to run multiple shifts? Is capacity flexible so that output can be efficiently and cost-effectively adjusted to accommodate both long and short runs?

Innovation is the driving force in the pharmaceutical industry, so technology is its engine. It is, therefore, critical that a pharmaceutical packager be on the cutting edge of technology. Is the packager forward-thinking and do they have a proven history of staying on the leading end of technology? Are they well-equipped to produce the fast-growing pharmaceutical packaging formats, such as blister – considered to grow at a faster rate than other segments of the pharmaceutical packaging industry – and stick-packs, whose high rate of acceptance in Asia and Europe is propelling its popularity in North America? Both formats require controlled environments, and not all packagers have the technology and systems infrastructure to meet those stringent requirements.

Do they offer state-of-the-industry dedicated production environments with low relative humidity and controlled and monitored temperature? Is equipment aligned with new regulations, increased standards for infection control and other issues of safety, integrity, uniformity, purity and stability? Do they employ the brightest minds in the business who are progressive and will competently navigate the everchanging course of innovation and technology?

Being a dynamic contract packaging partner requires considerable financial leverage, a major factor yet often not addressed. Wanting to stay on the forefront of the industry and having the skills to do so will go only so far. It is the capital and the available credit that get the job done. Explore whether or not the packager has the financial resources to expand staff and space; to retool or invest in upgrades to the infrastructure. Are there updated and efficient HVAC ventilation and other mechanical systems to ensure product protection from manufacture to distribution?

Competition is fierce. Demand is great. Regulations are stringent. Innovation is the future. So as the global pharmaceutical market grows rapidly and becomes ever more dependent on contract service providers to keep pace, the consequence of aligning with the right partner carries greater weight – and requires heightened consideration.

References:

1 Global Pharmaceutical Industry 2013-2018: Trend, Profit, and Forecast Analysis, August 2013, Lucintel

2 7th Annual Outsourcing Survey. Contract Pharma, March 2012

Download the File